Filing taxes in Canada is a crucial requirement for several reasons, impacting not just your compliance with the law but also your financial health and access to various benefits. Here are the key reasons why you need to file your taxes in Canada:

Legal Requirement: The Canada Revenue Agency (CRA) mandates that all residents who earn income must file a tax return every year. Filing your taxes is part of fulfilling your legal obligations and ensures you avoid any penalties for non-compliance.

Refunds: If you’ve had more tax withheld from your income than you owe, you’re entitled to a refund. The only way to receive this refund is by filing a tax return. Many Canadians look forward to their tax refunds as a form of forced savings that they can receive annually.

Benefit Payments: Filing your taxes determines your eligibility for various federal and provincial benefit programs, such as the Canada Child Benefit (CCB), Goods and Services Tax/Harmonized Sales Tax (GST/HST) credit, and provincial credits. These benefits can provide significant financial assistance throughout the year.

RRSP Contributions: Your tax return information is used to calculate your new Registered Retirement Savings Plan (RRSP) contribution room for the next year. Contributing to an RRSP is a key strategy for retirement planning and can lead to tax deductions.

Loan Applications: Applying for loans or mortgages often requires proof of income, which your Notice of Assessment (received after filing taxes) can provide. This document is crucial for proving your financial standing to lenders.

Carrying Forward or Transferring Credits: If you don’t owe taxes this year, filing your return allows you to carry forward unused tuition, education, and textbook amounts. Additionally, students can transfer these amounts to a parent, grandparent, spouse, or common-law partner, which can only be done through the tax filing process.

Tracking Your Contribution Room: Filing taxes helps track contribution room for tax-advantaged accounts like the Tax-Free Savings Account (TFSA) and RRSP. Knowing your contribution room can help in planning your savings and investment strategies.

Settling Estate Matters: In the event of death, a final tax return must be filed to settle the individual’s tax affairs, ensuring that any owed taxes are paid or refunds are claimed.

Establishing Residency for Tuition: For students, filing taxes in Canada can help establish residency status, which is often required for eligibility for lower domestic tuition rates at universities and colleges.

Maintaining Continuous Records: Filing annual tax returns helps maintain a continuous record of your financial history, which can be beneficial for personal bookkeeping and future financial planning.

Filing your taxes is not just about compliance; it’s a critical component of managing your personal finances, accessing government benefits, and planning for your future in Canada.

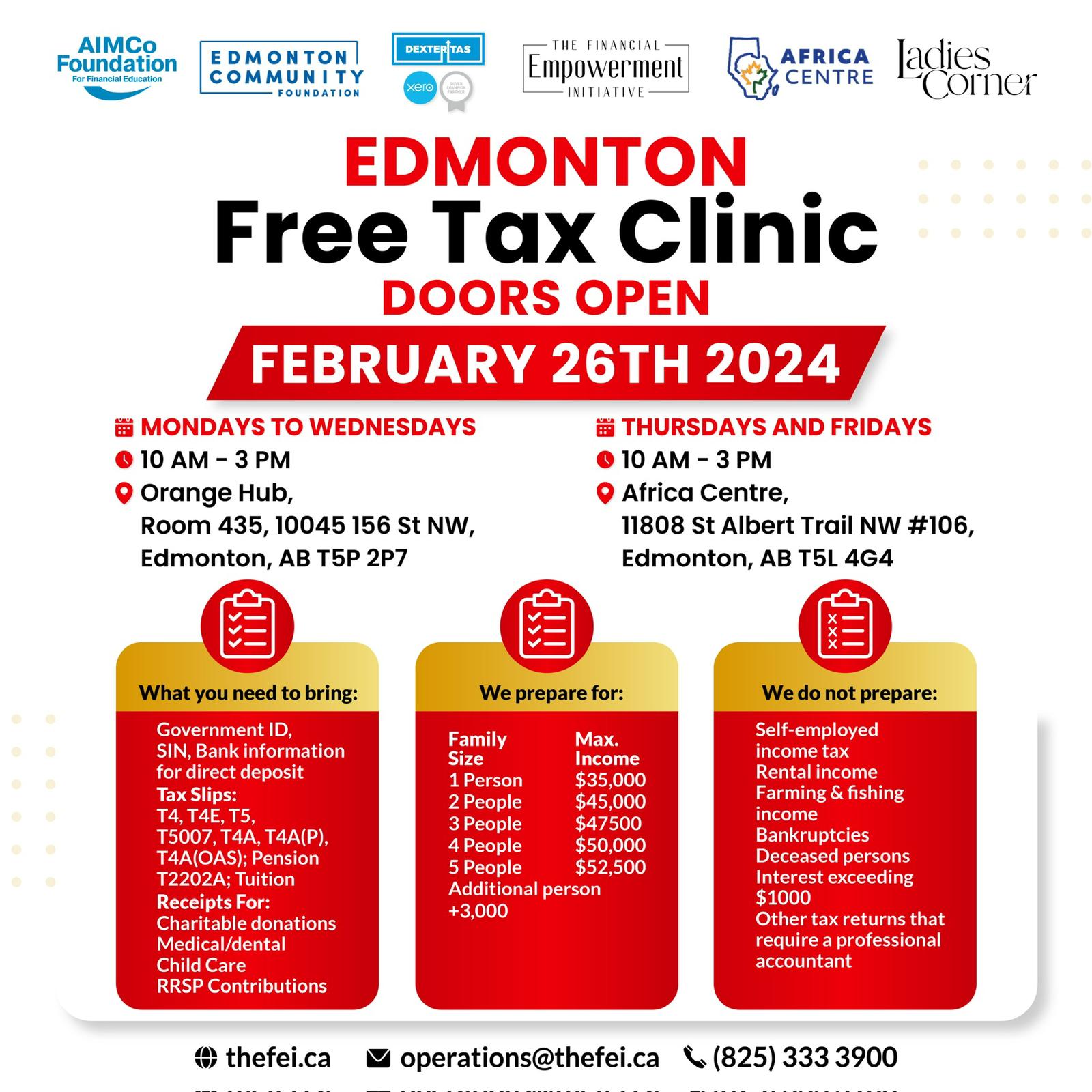

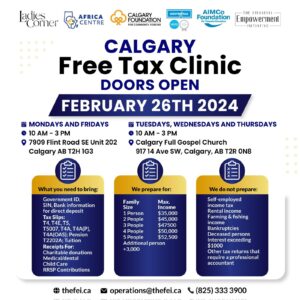

Thefei.ca is filing taxes for low-income members of the community. They are based in Calgary and Edmonton.

Here is how to book an appointment:

Booking Your Appointment:

Residents interested in utilizing these free services can secure an appointment by texting or calling the following numbers. Please mention your preferred date, time, and whether you prefer an in-person or virtual session.

Calgary Appointments: Text or Call (403) 554 2861

Locations:

7909 Flint Road SE Unit 202, Calgary, AB, on Mondays and Fridays, 10 am – 3 pm.

Calgary Full Gospel Church, 917 14 Avenue SW, Calgary, AB, on Tuesdays, Wednesdays, and Thursdays, 10 am – 3 pm.

Edmonton Appointments: Text or Call (825) 333 3900

Locations:

Orange Hub, Room 435, 10045 156 Street NW, Edmonton, AB, on Mondays to Wednesdays, 10 am – 3 pm.

Africa Centre, 11808 St Albert Trail NW #106, Edmonton, AB, on Thursdays and Fridays, 10 am – 3 pm.